HWG Capital – Fintech Scion Limited files on Securities Commission – USHWG Capital

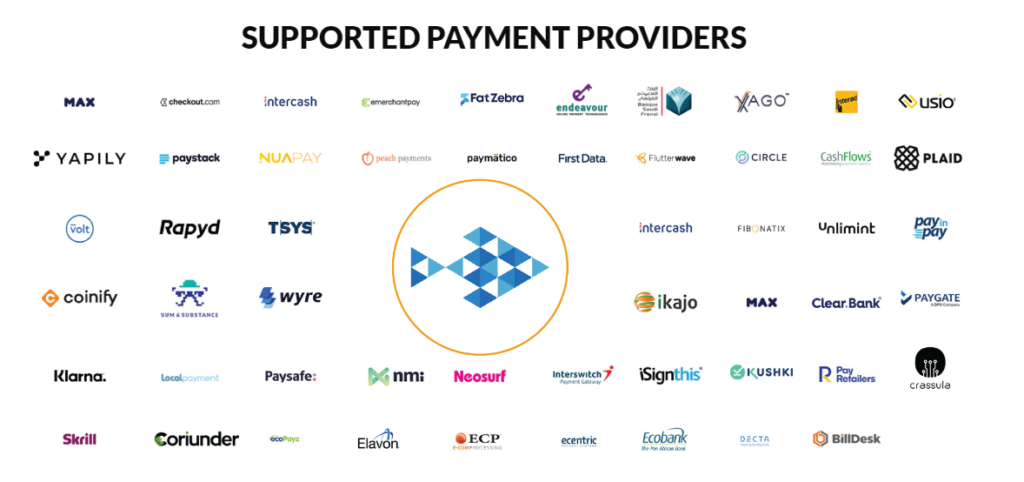

HWG Capital – Fintech Scion Limited files on Securities Commission – US Fintech Scion Limited, a collaborative partner of HWG Capital have file for listing through the Securities Commission in the United States (US). Fintech Scion : A Game-Changer in Digital Payments Overview In a bid to revolutionize the financial landscape, a promising fintech company , Fintech Scion has submitted its bid to the Securities Commission in the US for its future listing. With a groundbreaking digital Software-as-a-Service (SaaS) platform in tow, the company sets its sights on empowering merchants by furnishing them with an integrated suite of tools and solutions. This move is poised to streamline payment services, unlocking a realm of secure, online, and fully managed transactions and settlements. At the heart of Fintech Scion, lies a sophisticated financial ecosystem, underpinned by a robust technological infrastructure meticulously developed to empower financial institutions. With a mission to offer seamless, consolidated experiences across diverse verticals encompassing business-to-business, business-to-consumer, and consumer-to-business domains, the company is poised to redefine industry standards. Image Source: https://www.hwgcash.com/solution.php The company’s current clientele spans a myriad of enterprises and organizations across varied sectors, all sharing a common objective: to minimize intricacies and costs associated with fund transfers. Catering specifically to online businesses, their comprehensive solutions include payment collection, cross-border transactions, FX services, and corporate bank accounts, offering a lifeline to small and medium enterprises (SMEs) and other online businesses. With an extensive suite of integrated payment products and services tailored to various channels, including in-store, online, and mobile interfaces, the company is poised to redefine the payments landscape. Their offerings encompass end-to-end payment processing, merchant acquiring and issuing, diverse methods of mobile and contactless payments, and QR code-based solutions. By seamlessly integrating e-money remittance solutions within the global marketplace, the company’s SaaS model empowers clients to focus on core operations while entrusting the intricacies of payment processing to experts. This streamlined approach not only facilitates efficient onboarding and elevates customer retention but also cultivates new revenue streams for businesses. With a vision that transcends boundaries, the company aspires to solidify its position as a global leader in the payments and banking sphere and is currently submitted its listing efforts to leap forward with further expansion and enhancements to achieve its goals. Description of Securities General Our authorized capital stock consists of 425,000,000 shares, consisting of shares of common stock and shares of preferred stock: 400,000,000 shares of common stock, $0.01 par value per share; and 25,000,000 shares of preferred stock, $0.01 par value per share. As of April 15, 2024, there are 19,874,265 shares of common stock outstanding and 0 shares of preferred stock outstanding, For further insights and submission info, delve into the full submission information [here] (https://www.otcmarkets.com/filing/html?id=17481943&guid=yDQ-kePydbK-B3h#G084201_S-1_HTM_a016_v1)

HWG Capital – Fintech Scion Limited files on Securities Commission – USHWG Capital Read More »